Coal Age Magazine - For more than 100 years, Coal Age has been the magazine that readers can trust for guidance and insight on this important industry.

Issue link: https://coal.epubxp.com/i/1032065

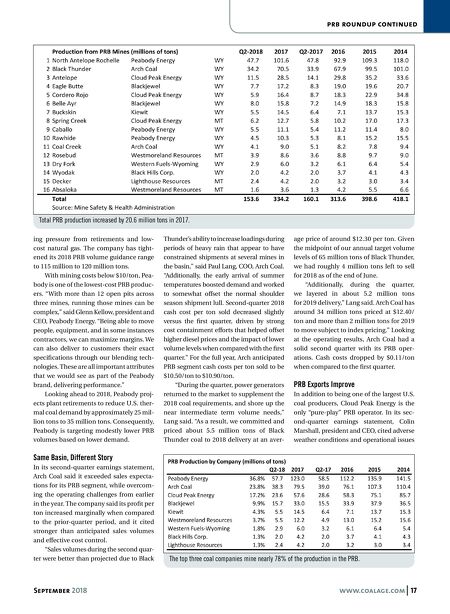

16 www.coalage.com September 2018 prb roundup PRB Production Regains Momentum in 2017 Midway through 2018, however, some producers are revising production guidance figures downward by steve fiscor, editor-in-chief Gillette, Wyoming, was ground zero when the coal industry took its big hit in 2016. When total national coal production fig - ures fell to levels not seen since the 1980s, production from the Powder River Basin (PRB) mines fell from nearly 400 million tons to 314 million tons. While one could compare losses in other regions of the U.S. on a Btu basis, this amounted to 16 fewer unit trains per day leaving the PRB. Last year, coal demand improved steadily and PRB production recovered by more than 20 million tons to 334 mil- lion tons. This year, demand has flattened or decreased and at the mid-year point it looks as though 2018 might end up look - ing a lot more like 2016 than 2017 from a total tonnage standpoint. On the surface, not much has changed among the leaders. One-half of the mines (eight of 16) are controlled by four compa- nies: Peabody Energy, Arch Coal, Cloud Peak Energy and Blackjewel. A privately held coal company based in Appalachia, Blackjewel purchased the Alpha Coal West mines (Eagle Butte and Belle Ayr) when Contura Energy was spun off from Alpha Natural Resources. With its massive North Antelope Ro- chelle complex producing more than 100 million tons per year (tpy), Peabody En- ergy mined 123 million tons of PRB coal in 2017. Arch Coal produced nearly 80 million tons of PRB coal in 2017, most of which came from the company's Black Thunder mine (70 million tons). Cloud Peak Energy produced nearly 58 mil- lion tons from three mines in 2017, while Blackjewel produced 33 million tons. On a mine-by-mine basis, Kiewit's Buckskin mine more than doubled its pro- duction in 2017 to 14.5 million tons from 7.1 million tons in 2016. That propelled it from the No. 12 position to the No. 7 po- sition. Increased production at Peabody's Rawhide mine allowed it to swap positions with Arch Coal's Coal Creek mine. The two Westmoreland mines, Rosebud and Absa- loka, fell to No. 12 and No. 16, respectively, which pushed Wyodak and Decker higher in the production rankings. By the end 2017, utility consump- tion of southern PRB coal had increased compared to the prior year. As a result, southern PRB coal inventories had de- clined 9 million tons from the prior year to 54 days of maximum burn. The average year-end stockpiles were at low levels that had not been seen since 2014. It seemed as thought the industry was ready to rally again in 2018, but that has not happened and few are expecting it to happen as the industry entered the third quarter of 2018. Market Conditions Remain Challenging By the end of last year, Peabody recorded an 11% increase in PRB coal shipments. PRB coal consumption as a whole was relative- ly flat during the first quarter of 2018 and Peabody reported some sequencing issues with overburden removal in the PRB. The company was expecting the traditional low- er shoulder season (the time between peak and off-peak demand) for PRB volumes in the second quarter and then the rain set in. In its second-quarter earnings report, Peabody Energy noted that the North An- telope Rochelle mine (NARM) suffered from higher fuels costs and experienced record rainfall. "To put the wet weather in perspective for the PRB, year-to-date, NARM received more than 16 inches (in.) of rain through the middle of July," said Amy Schwetz, executive vice president and CFO. "This compares to an average of about 13 in. per year and a previous annual record of 15.7 in. in 2014. While we expected the volumes to be down due to the traditional shoulder season demand, the unprecedent- ed amount of rainfall impacted volumes by an additional 1.5 million tons at NARM." Record rainfall aside, the largest U.S. coal producer said conditions remain challenging, as utility coal consumption has declined 5% from a year ago, despite a 4.5% increase in total load. Peabody said PRB demand decreased 5% due to ongo- An electric shovel loads coal into a haul truck at the Spring Creek mine. (Photo:Cloud Peak Energy)