Coal Age Magazine - For more than 100 years, Coal Age has been the magazine that readers can trust for guidance and insight on this important industry.

Issue link: https://coal.epubxp.com/i/1032065

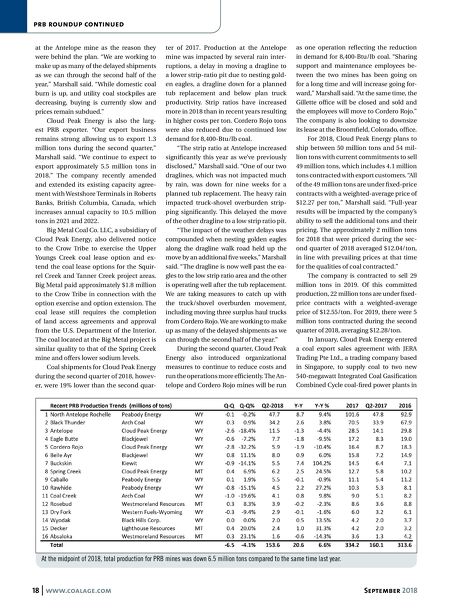

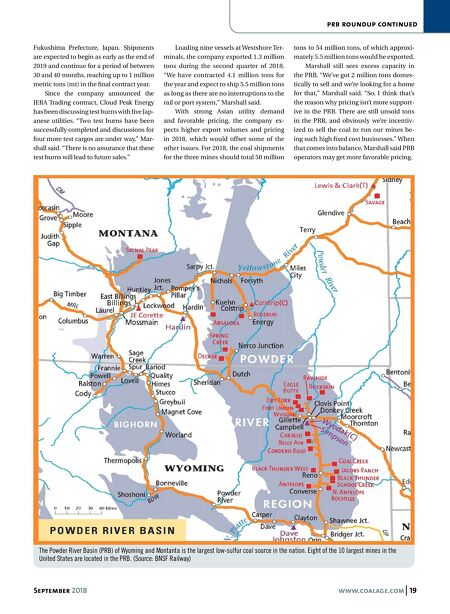

18 www.coalage.com September 2018 prb roundup continued at the Antelope mine as the reason they were behind the plan. "We are working to make up as many of the delayed shipments as we can through the second half of the year," Marshall said. "While domestic coal burn is up, and utility coal stockpiles are decreasing, buying is currently slow and prices remain subdued." Cloud Peak Energy is also the larg- est PRB exporter. "Our export business remains strong allowing us to export 1.3 million tons during the second quarter," Marshall said. "We continue to expect to export approximately 5.5 million tons in 2018." The company recently amended and extended its existing capacity agree- ment with Westshore Terminals in Roberts Banks, British Columbia, Canada, which increases annual capacity to 10.5 million tons in 2021 and 2022. Big Metal Coal Co. LLC, a subsidiary of Cloud Peak Energy, also delivered notice to the Crow Tribe to exercise the Upper Youngs Creek coal lease option and ex- tend the coal lease options for the Squir- rel Creek and Tanner Creek project areas. Big Metal paid approximately $1.8 million to the Crow Tribe in connection with the option exercise and option extension. The coal lease still requires the completion of land access agreements and approval from the U.S. Department of the Interior. The coal located at the Big Metal project is similar quality to that of the Spring Creek mine and offers lower sodium levels. Coal shipments for Cloud Peak Energy during the second quarter of 2018, howev- er, were 19% lower than the second quar- ter of 2017. Production at the Antelope mine was impacted by several rain inter- ruptions, a delay in moving a dragline to a lower strip-ratio pit due to nesting gold- en eagles, a dragline down for a planned tub replacement and below plan truck productivity. Strip ratios have increased more in 2018 than in recent years resulting in higher costs per ton. Cordero Rojo tons were also reduced due to continued low demand for 8,400-Btu/lb coal. "The strip ratio at Antelope increased significantly this year as we've previously disclosed," Marshall said. "One of our two draglines, which was not impacted much by rain, was down for nine weeks for a planned tub replacement. The heavy rain impacted truck-shovel overburden strip- ping significantly. This delayed the move of the other dragline to a low strip ratio pit. "The impact of the weather delays was compounded when nesting golden eagles along the dragline walk road held up the move by an additional five weeks," Marshall said. "The dragline is now well past the ea- gles to the low strip ratio area and the other is operating well after the tub replacement. We are taking measures to catch up with the truck/shovel overburden movement, including moving three surplus haul trucks from Cordero Rojo. We are working to make up as many of the delayed shipments as we can through the second half of the year." During the second quarter, Cloud Peak Energy also introduced organizational measures to continue to reduce costs and run the operations more efficiently. The An- telope and Cordero Rojo mines will be run as one operation reflecting the reduction in demand for 8,400-Btu/lb coal. "Sharing support and maintenance employees be- tween the two mines has been going on for a long time and will increase going for- ward," Marshall said. "At the same time, the Gillette office will be closed and sold and the employees will move to Cordero Rojo." The company is also looking to downsize its lease at the Broomfield, Colorado, office. For 2018, Cloud Peak Energy plans to ship between 50 million tons and 54 mil- lion tons with current commitments to sell 49 million tons, which includes 4.1 million tons contracted with export customers. "All of the 49 million tons are under fixed-price contracts with a weighted-average price of $12.27 per ton," Marshall said. "Full-year results will be impacted by the company's ability to sell the additional tons and their pricing. The approximately 2 million tons for 2018 that were priced during the sec- ond quarter of 2018 averaged $12.04/ton, in line with prevailing prices at that time for the qualities of coal contracted." The company is contracted to sell 29 million tons in 2019. Of this committed production, 22 million tons are under fixed- price contracts with a weighted-average price of $12.55/ton. For 2019, there were 5 million tons contracted during the second quarter of 2018, averaging $12.28/ton. In January, Cloud Peak Energy entered a coal export sales agreement with JERA Trading Pte Ltd., a trading company based in Singapore, to supply coal to two new 540-megawatt Integrated Coal Gasification Combined Cycle coal-fired power plants in At the midpoint of 2018, total production for PRB mines was down 6.5 million tons compared to the same time last year.