Coal Age Magazine - For more than 100 years, Coal Age has been the magazine that readers can trust for guidance and insight on this important industry.

Issue link: https://coal.epubxp.com/i/1055558

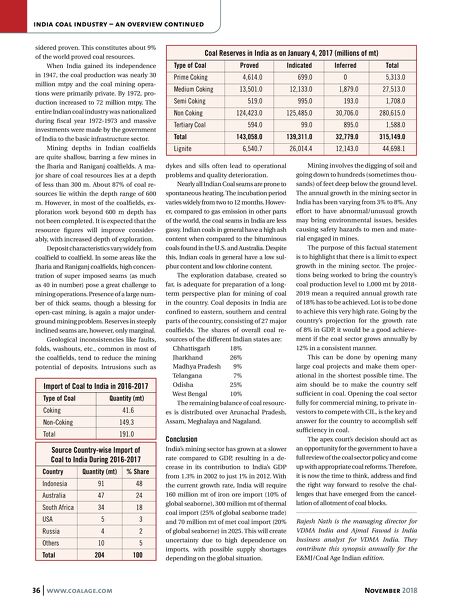

0 0 36 www.coalage.com November 2018 india coal industry – an overview continued sidered proven. This constitutes about 9% of the world proved coal resources. When India gained its independence in 1947, the coal production was nearly 30 million mtpy and the coal mining opera- tions were primarily private. By 1972, pro- duction increased to 72 million mtpy. The entire Indian coal industry was nationalized during fiscal year 1972-1973 and massive investments were made by the government of India to the basic infrastructure sector. Mining depths in Indian coalfields are quite shallow, barring a few mines in the Jharia and Raniganj coalfields. A ma- jor share of coal resources lies at a depth of less than 300 m. About 87% of coal re- sources lie within the depth range of 600 m. However, in most of the coalfields, ex- ploration work beyond 600 m depth has not been completed. It is expected that the resource figures will improve consider- ably, with increased depth of exploration. Deposit characteristics vary widely from coalfield to coalfield. In some areas like the Jharia and Raniganj coalfields, high concen- tration of super imposed seams (as much as 40 in number) pose a great challenge to mining operations. Presence of a large num- ber of thick seams, though a blessing for open-cast mining, is again a major under- ground mining problem. Reserves in steeply inclined seams are, however, only marginal. Geological inconsistencies like faults, folds, washouts, etc., common in most of the coalfields, tend to reduce the mining potential of deposits. Intrusions such as dykes and sills often lead to operational problems and quality deterioration. Nearly all Indian Coal seams are prone to spontaneous heating. The incubation period varies widely from two to 12 months. Howev- er, compared to gas emission in other parts of the world, the coal seams in India are less gassy. Indian coals in general have a high ash content when compared to the bituminous coals found in the U.S. and Australia. Despite this, Indian coals in general have a low sul- phur content and low chlorine content. The exploration database, created so far, is adequate for preparation of a long- term perspective plan for mining of coal in the country. Coal deposits in India are confined to eastern, southern and central parts of the country, consisting of 27 major coalfields. The shares of overall coal re- sources of the different Indian states are: Chhattisgarh 18% Jharkhand 26% Madhya Pradesh 9% Telangana 7% Odisha 25% West Bengal 10% The remaining balance of coal resourc- es is distributed over Arunachal Pradesh, Assam, Meghalaya and Nagaland. Conclusion India's mining sector has grown at a slower rate compared to GDP, resulting in a de- crease in its contribution to India's GDP from 1.3% in 2002 to just 1% in 2012. With the current growth rate, India will require 160 million mt of iron ore import (10% of global seaborne), 300 million mt of thermal coal import (25% of global seaborne trade) and 70 million mt of met coal import (20% of global seaborne) in 2025. This will create uncertainty due to high dependence on imports, with possible supply shortages depending on the global situation. Mining involves the digging of soil and going down to hundreds (sometimes thou- sands) of feet deep below the ground level. The annual growth in the mining sector in India has been varying from 3% to 8%. Any effort to have abnormal/unusual growth may bring environmental issues, besides causing safety hazards to men and mate- rial engaged in mines. The purpose of this factual statement is to highlight that there is a limit to expect growth in the mining sector. The projec- tions being worked to bring the country's coal production level to 1,000 mt by 2018- 2019 mean a required annual growth rate of 18% has to be achieved. Lot is to be done to achieve this very high rate. Going by the country's projection for the growth rate of 8% in GDP, it would be a good achieve- ment if the coal sector grows annually by 12% in a consistent manner. This can be done by opening many large coal projects and make them oper- ational in the shortest possible time. The aim should be to make the country self sufficient in coal. Opening the coal sector fully for commercial mining, to private in- vestors to compete with CIL, is the key and answer for the country to accomplish self sufficiency in coal. The apex court's decision should act as an opportunity for the government to have a full review of the coal sector policy and come up with appropriate coal reforms. Therefore, it is now the time to think, address and find the right way forward to resolve the chal- lenges that have emerged from the cancel- lation of allotment of coal blocks. Rajesh Nath is the managing director for VDMA India and Ajmal Fawad is India business analyst for VDMA India. They contribute this synopsis annually for the E&MJ;/Coal Age Indian edition. Import of Coal to India in 2016-2017 Type of Coal Quantity (mt) Coking 0 41.6 Non-Coking 149.3 Total 191.0 Source Country-wise Import of Coal to India During 2016-2017 Country Quantity (mt) % Share Indonesia 0 91 0 48 Australia 0 47 0 24 South Africa 0 34 0 18 USA 00 5 00 3 Russia 00 4 00 2 Others 0 10 00 5 Total 204 100 Coal Reserves in India as on January 4, 2017 (millions of mt) Type of Coal Proved Indicated Inferred Total Prime Coking 00 4,614.0 000, 699.0 0 00 5,313.0 Medium Coking 0 13,501.0 0 12,133.0 00 1,879.0 0 27,513.0 Semi Coking 000, 519.0 000, 995.0 000, 193.0 00 1,708.0 Non Coking 124,423.0 125,485.0 0 30,706.0 280,615.0 Tertiary Coal 000, 594.0 000,0 99.0 000, 895.0 00 1,588.0 Total 143,058.0 139,311.0 0 32,779.0 315,149.0 Lignite 00 6,540.7 0 26,014.4 0 12,143.0 0 44,698.1