Coal Age Magazine - For more than 100 years, Coal Age has been the magazine that readers can trust for guidance and insight on this important industry.

Issue link: https://coal.epubxp.com/i/1066352

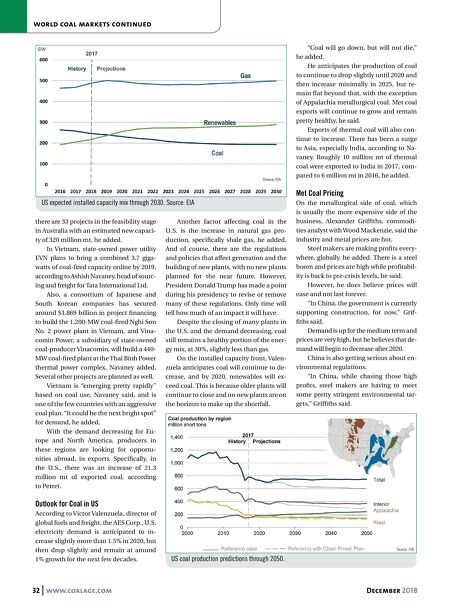

32 www.coalage.com December 2018 world coal markets continued there are 33 projects in the feasibility stage in Australia with an estimated new capaci- ty of 320 million mt, he added. In Vietnam, state-owned power utility EVN plans to bring a combined 3.7 giga- watts of coal-fired capacity online by 2019, according to Ashish Navaney, head of sourc- ing and freight for Tata International Ltd. Also, a consortium of Japanese and South Korean companies has secured around $1.869 billion in project financing to build the 1,200-MW coal-fired Nghi Son No. 2 power plant in Vietnam, and Vina- comin Power, a subsidiary of state-owned coal-producer Vinacomin, will build a 440- MW coal-fired plant at the Thai Binh Power thermal power complex, Navaney added. Several other projects are planned as well. Vietnam is "emerging pretty rapidly" based on coal use, Navaney said, and is one of the few countries with an aggressive coal plan. "It could be the next bright spot" for demand, he added. With the demand decreasing for Eu- rope and North America, producers in these regions are looking for opportu- nities abroad, in exports. Specifically, in the U.S., there was an increase of 21.3 million mt of exported coal, according to Perret. Outlook for Coal in US According to Victor Valenzuela, director of global fuels and freight, the AES Corp., U.S. electricity demand is anticipated to in- crease slightly more than 1.5% in 2020, but then drop slightly and remain at around 1% growth for the next few decades. Another factor affecting coal in the U.S. is the increase in natural gas pro- duction, specifically shale gas, he added. And of course, there are the regulations and policies that affect generation and the building of new plants, with no new plants planned for the near future. However, President Donald Trump has made a point during his presidency to revise or remove many of these regulations. Only time will tell how much of an impact it will have. Despite the closing of many plants in the U.S. and the demand decreasing, coal still remains a healthy portion of the ener- gy mix, at 30%, slightly less than gas. On the installed capacity front, Valen- zuela anticipates coal will continue to de- crease, and by 2020, renewables will ex- ceed coal. This is because older plants will continue to close and no new plants are on the horizon to make up the shortfall. "Coal will go down, but will not die," he added. He anticipates the production of coal to continue to drop slightly until 2020 and then increase minimally in 2025, but re- main flat beyond that, with the exception of Appalachia metallurgical coal. Met coal exports will continue to grow and remain pretty healthy, he said. Exports of thermal coal will also con- tinue to increase. There has been a surge to Asia, especially India, according to Na- vaney. Roughly 10 million mt of thermal coal were exported to India in 2017, com- pared to 6 million mt in 2016, he added. Met Coal Pricing On the metallurgical side of coal, which is usually the more expensive side of the business, Alexander Griffiths, commodi- ties analyst with Wood Mackenzie, said the industry and metal prices are hot. Steel makers are making profits every- where, globally, he added. There is a steel boom and prices are high while profitabil- ity is back to pre-crisis levels, he said. However, he does believe prices will ease and not last forever. "In China, the government is currently supporting construction, for now," Grif- fiths said. Demand is up for the medium term and prices are very high, but he believes that de- mand will begin to decrease after 2020. China is also getting serious about en- vironmental regulations. "In China, while chasing those high profits, steel makers are having to meet some pretty stringent environmental tar- gets," Griffiths said. US expected installed capacity mix through 2030. Source: EIA US coal production predictions through 2050.