Coal Age Magazine - For more than 100 years, Coal Age has been the magazine that readers can trust for guidance and insight on this important industry.

Issue link: https://coal.epubxp.com/i/943908

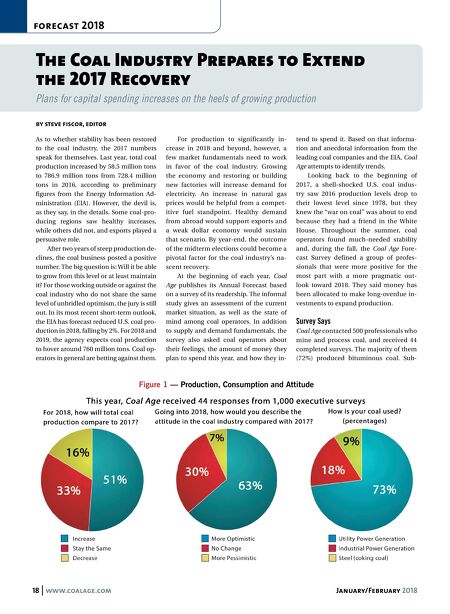

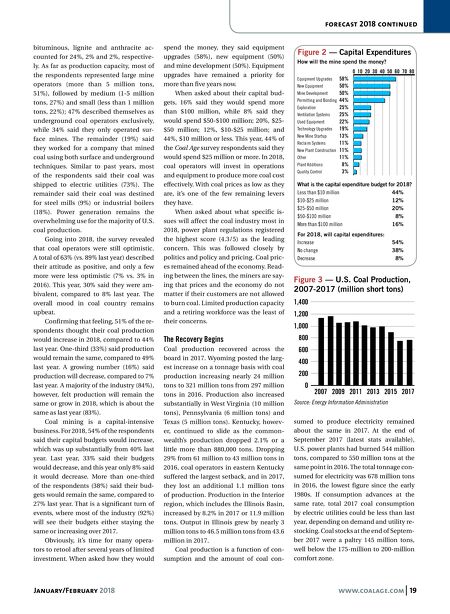

0, 0, 0, 0, 0,00 January/February 2018 www.coalage.com 19 forecast 2018 continued bituminous, lignite and anthracite ac- counted for 24%, 2% and 2%, respective- ly. As far as production capacity, most of the respondents represented large mine operators (more than 5 million tons, 51%), followed by medium (1-5 million tons, 27%) and small (less than 1 million tons, 22%); 47% described themselves as underground coal operators exclusively, while 34% said they only operated sur- face mines. The remainder (19%) said they worked for a company that mined coal using both surface and underground techniques. Similar to past years, most of the respondents said their coal was shipped to electric utilities (73%). The remainder said their coal was destined for steel mills (9%) or industrial boilers (18%). Power generation remains the overwhelming use for the majority of U.S. coal production. Going into 2018, the survey revealed that coal operators were still optimistic. A total of 63% (vs. 89% last year) described their attitude as positive, and only a few more were less optimistic (7% vs. 3% in 2016). This year, 30% said they were am- bivalent, compared to 8% last year. The overall mood in coal country remains upbeat. Confirming that feeling, 51% of the re- spondents thought their coal production would increase in 2018, compared to 44% last year. One-third (33%) said production would remain the same, compared to 49% last year. A growing number (16%) said production will decrease, compared to 7% last year. A majority of the industry (84%), however, felt production will remain the same or grow in 2018, which is about the same as last year (83%). Coal mining is a capital-intensive business. For 2018, 54% of the respondents said their capital budgets would increase, which was up substantially from 40% last year. Last year, 33% said their budgets would decrease, and this year only 8% said it would decrease. More than one-third of the respondents (38%) said their bud- gets would remain the same, compared to 27% last year. That is a significant turn of events, where most of the industry (92%) will see their budgets either staying the same or increasing over 2017. Obviously, it's time for many opera- tors to retool after several years of limited investment. When asked how they would spend the money, they said equipment upgrades (58%), new equipment (50%) and mine development (50%). Equipment upgrades have remained a priority for more than five years now. When asked about their capital bud- gets, 16% said they would spend more than $100 million, while 8% said they would spend $50-$100 million; 20%, $25- $50 million; 12%, $10-$25 million; and 44%, $10 million or less. This year, 44% of the Coal Age survey respondents said they would spend $25 million or more. In 2018, coal operators will invest in operations and equipment to produce more coal cost effectively. With coal prices as low as they are, it's one of the few remaining levers they have. When asked about what specific is- sues will affect the coal industry most in 2018, power plant regulations registered the highest score (4.3/5) as the leading concern. This was followed closely by politics and policy and pricing. Coal pric- es remained ahead of the economy. Read- ing between the lines, the miners are say- ing that prices and the economy do not matter if their customers are not allowed to burn coal. Limited production capacity and a retiring workforce was the least of their concerns. The Recovery Begins Coal production recovered across the board in 2017. Wyoming posted the larg- est increase on a tonnage basis with coal production increasing nearly 24 million tons to 321 million tons from 297 million tons in 2016. Production also increased substantially in West Virginia (10 million tons), Pennsylvania (6 million tons) and Texas (5 million tons). Kentucky, howev- er, continued to slide as the common- wealth's production dropped 2.1% or a little more than 880,000 tons. Dropping 29% from 61 million to 43 million tons in 2016, coal operators in eastern Kentucky suffered the largest setback, and in 2017, they lost an additional 1.1 million tons of production. Production in the Interior region, which includes the Illinois Basin, increased by 8.2% in 2017 or 11.9 million tons. Output in Illinois grew by nearly 3 million tons to 46.5 million tons from 43.6 million in 2017. Coal production is a function of con- sumption and the amount of coal con- sumed to produce electricity remained about the same in 2017. At the end of September 2017 (latest stats available), U.S. power plants had burned 544 million tons, compared to 550 million tons at the same point in 2016. The total tonnage con- sumed for electricity was 678 million tons in 2016, the lowest figure since the early 1980s. If consumption advances at the same rate, total 2017 coal consumption by electric utilities could be less than last year, depending on demand and utility re- stocking. Coal stocks at the end of Septem- ber 2017 were a paltry 145 million tons, well below the 175-million to 200-million comfort zone. Figure 3 — U.S. Coal Production, 2007-2017 (million short tons) 1,400 1,200 1,000 800 600 400 200 0 2007 2009 2011 2013 2015 2017 Source: Energy Information Administration Figure 2 — Capital Expenditures How will the mine spend the money? 0 10 20 30 40 50 60 70 80 Equipment Upgrades 58% New Equipment 50% Mine Development 50% Permitting and Bonding 44% Exploration 25% Ventilation Systems 25% Used Equipment 22% Technology Upgrades 19% New Mine Startup 13% Reclaim Systems 11% New Plant Construction 11% Other 11% Plant Additions 8% Quality Control 3% What is the capital expenditure budget for 2018? Less than $10 million 44% $10-$25 million 12% $25-$50 million 20% $50-$100 million 8% More than $100 million 16% For 2018, will capital expenditures: Increase 54% No change 38% Decrease 8%