Coal Age Magazine - For more than 100 years, Coal Age has been the magazine that readers can trust for guidance and insight on this important industry.

Issue link: https://coal.epubxp.com/i/943908

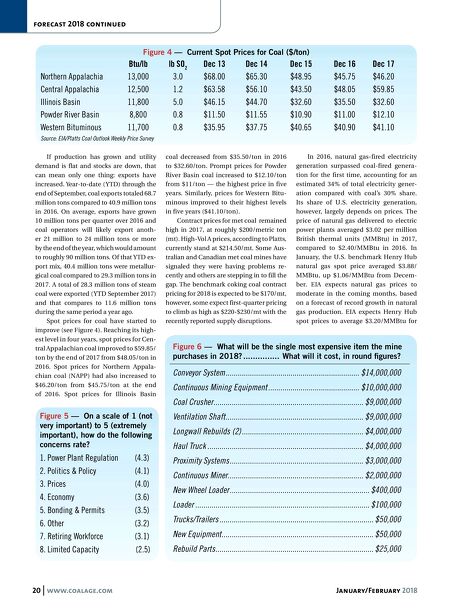

20 www.coalage.com January/February 2018 forecast 2018 continued If production has grown and utility demand is flat and stocks are down, that can mean only one thing: exports have increased. Year-to-date (YTD) through the end of September, coal exports totaled 68.7 million tons compared to 40.9 million tons in 2016. On average, exports have grown 10 million tons per quarter over 2016 and coal operators will likely export anoth- er 21 million to 24 million tons or more by the end of the year, which would amount to roughly 90 million tons. Of that YTD ex- port mix, 40.4 million tons were metallur- gical coal compared to 29.3 million tons in 2017. A total of 28.3 million tons of steam coal were exported (YTD September 2017) and that compares to 11.6 million tons during the same period a year ago. Spot prices for coal have started to improve (see Figure 4). Reaching its high- est level in four years, spot prices for Cen- tral Appalachian coal improved to $59.85/ ton by the end of 2017 from $48.05/ton in 2016. Spot prices for Northern Appala- chian coal (NAPP) had also increased to $46.20/ton from $45.75/ton at the end of 2016. Spot prices for Illinois Basin coal decreased from $35.50/ton in 2016 to $32.60/ton. Prompt prices for Powder River Basin coal increased to $12.10/ton from $11/ton — the highest price in five years. Similarly, prices for Western Bitu- minous improved to their highest levels in five years ($41.10/ton). Contract prices for met coal remained high in 2017, at roughly $200/metric ton (mt). High-Vol A prices, according to Platts, currently stand at $214.50/mt. Some Aus- tralian and Canadian met coal mines have signaled they were having problems re- cently and others are stepping in to fill the gap. The benchmark coking coal contract pricing for 2018 is expected to be $170/mt, however, some expect first-quarter pricing to climb as high as $220-$230/mt with the recently reported supply disruptions. In 2016, natural gas-fired electricity generation surpassed coal-fired genera- tion for the first time, accounting for an estimated 34% of total electricity gener- ation compared with coal's 30% share. Its share of U.S. electricity generation, however, largely depends on prices. The price of natural gas delivered to electric power plants averaged $3.02 per million British thermal units (MMBtu) in 2017, compared to $2.40/MMBtu in 2016. In January, the U.S. benchmark Henry Hub natural gas spot price averaged $3.88/ MMBtu, up $1.06/MMBtu from Decem- ber. EIA expects natural gas prices to moderate in the coming months, based on a forecast of record growth in natural gas production. EIA expects Henry Hub spot prices to average $3.20/MMBtu for Figure 5 — On a scale of 1 (not very important) to 5 (extremely important), how do the following concerns rate? 1. Power Plant Regulation (4.3) 2. Politics & Policy (4.1) 3. Prices (4.0) 4. Economy (3.6) 5. Bonding & Permits (3.5) 6. Other (3.2) 7. Retiring Workforce (3.1) 8. Limited Capacity (2.5) Figure 4 — Current Spot Prices for Coal ($/ton) Btu/lb lb SO 2 Dec 13 Dec 14 Dec 15 Dec 16 Dec 17 Northern Appalachia 13,000 3.0 $68.00 $65.30 $48.95 $45.75 $46.20 Central Appalachia 12,500 1.2 $63.58 $56.10 $43.50 $48.05 $59.85 Illinois Basin 11,800 5.0 $46.15 $44.70 $32.60 $35.50 $32.60 Powder River Basin 8,800 0.8 $11.50 $11.55 $10.90 $11.00 $12.10 Western Bituminous 11,700 0.8 $35.95 $37.75 $40.65 $40.90 $41.10 Source: EIA/Platts Coal Outlook Weekly Price Survey Figure 6 — What will be the single most expensive item the mine purchases in 2018? ............... What will it cost, in round fi gures? Conveyor System .................................................................. $14,000,000 Continuous Mining Equipment ............................................. $10,000,000 Coal Crusher .......................................................................... $9,000,000 Ventilation Shaft .................................................................... $9,000,000 Longwall Rebuilds (2) ............................................................ $4,000,000 Haul Truck ............................................................................. $4,000,000 Proximity Systems .................................................................. $3,000,000 Continuous Miner................................................................... $2,000,000 New Wheel Loader ..................................................................... $400,000 Loader ...................................................................................... $100,000 Trucks/Trailers ............................................................................ $50,000 New Equipment........................................................................... $50,000 Rebuild Parts .............................................................................. $25,000