Coal Age Magazine - For more than 100 years, Coal Age has been the magazine that readers can trust for guidance and insight on this important industry.

Issue link: https://coal.epubxp.com/i/943908

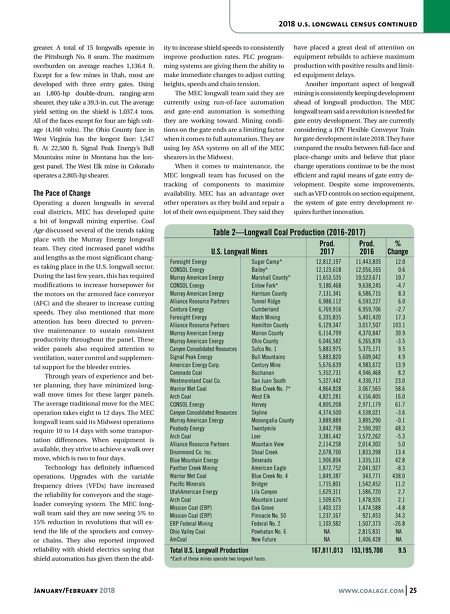

January/February 2018 www.coalage.com 25 2018 u.s. longwall census continued greater. A total of 15 longwalls operate in the Pittsburgh No. 8 seam. The maximum overburden on average reaches 1,136.4 ft. Except for a few mines in Utah, most are developed with three entry gates. Using an 1,805-hp double-drum, ranging-arm shearer, they take a 39.3-in. cut. The average yield setting on the shield is 1,037.4 tons. All of the faces except for four are high volt- age (4,160 volts). The Ohio County face in West Virginia has the longest face: 1,547 ft. At 22,500 ft, Signal Peak Energy's Bull Mountains mine in Montana has the lon- gest panel. The West Elk mine in Colorado operates a 2,805-hp shearer. The Pace of Change Operating a dozen longwalls in several coal districts, MEC has developed quite a bit of longwall mining expertise. Coal Age discussed several of the trends taking place with the Murray Energy longwall team. They cited increased panel widths and lengths as the most significant chang- es taking place in the U.S. longwall sector. During the last few years, this has required modifications to increase horsepower for the motors on the armored face conveyor (AFC) and the shearer to increase cutting speeds. They also mentioned that more attention has been directed to preven- tive maintenance to sustain consistent productivity throughout the panel. These wider panels also required attention to ventilation, water control and supplemen- tal support for the bleeder entries. Through years of experience and bet- ter planning, they have minimized long- wall move times for these larger panels. The average traditional move for the MEC operation takes eight to 12 days. The MEC longwall team said its Midwest operations require 10 to 14 days with some transpor- tation differences. When equipment is available, they strive to achieve a walk over move, which is two to four days. Technology has definitely influenced operations. Upgrades with the variable frequency drives (VFDs) have increased the reliability for conveyors and the stage- loader conveying system. The MEC long- wall team said they are now seeing 5% to 15% reduction in revolutions that will ex- tend the life of the sprockets and convey- or chains. They also reported improved reliability with shield electrics saying that shield automation has given them the abil- ity to increase shield speeds to consistently improve production rates. PLC program- ming systems are giving them the ability to make immediate changes to adjust cutting heights, speeds and chain tension. The MEC longwall team said they are currently using run-of-face automation and gate-end automation is something they are working toward. Mining condi- tions on the gate ends are a limiting factor when it comes to full automation. They are using Joy ASA systems on all of the MEC shearers in the Midwest. When it comes to maintenance, the MEC longwall team has focused on the tracking of components to maximize availability. MEC has an advantage over other operators as they build and repair a lot of their own equipment. They said they have placed a great deal of attention on equipment rebuilds to achieve maximum production with positive results and limit- ed equipment delays. Another important aspect of longwall mining is consistently keeping development ahead of longwall production. The MEC longwall team said a revolution is needed for gate entry development. They are currently considering a JOY Flexible Conveyor Train for gate development in late 2018. They have compared the results between full-face and place-change units and believe that place change operations continue to be the most efficient and rapid means of gate entry de- velopment. Despite some improvements, such as VFD controls on section equipment, the system of gate entry development re- quires further innovation. Table 2—Longwall Coal Production (2016-2017) Prod. Prod. % U.S. Longwall Mines 2017 2016 Change Foresight Energy Sugar Camp* 0 12,812,197 0 11,443,835 -0 12.0 CONSOL Energy Bailey* 0 12,123,618 0 12,056,165 -00 0.6 Murray American Energy Marshall County* 0 11,653,535 0 10,523,671 -0 10.7 CONSOL Energy Enlow Fork* 00 9,180,468 00 9,638,245 00 -4.7 Murray American Energy Harrison County 00 7,131,341 00 6,586,715 -00 8.3 Alliance Resource Partners Tunnel Ridge 00 6,988,112 00 6,593,227 -00 6.0 Contura Energy Cumberland 00 6,769,916 00 6,959,706 00 -2.7 Foresight Energy Mach Mining 00 6,335,835 00 5,401,420 -0 17.3 Alliance Resource Partners Hamilton County 00 6,129,347 00 3,017,507 - 103.1 Murray American Energy Marion County 00 6,114,799 00 4,370,847 -0 39.9 Murray American Energy Ohio County 00 6,046,582 00 6,265,878 00 -3.5 Canyon Consolidated Resources Sufco No. 1 00 5,883,975 00 5,375,171 -00 9.5 Signal Peak Energy Bull Mountains 00 5,883,820 00 5,609,042 -00 4.9 American Energy Corp. Century Mine 00 5,676,639 00 4,983,672 -0 13.9 Coronado Coal Buchanan 00 5,352,731 00 4,946,468 -00 8.2 Westmoreland Coal Co. San Juan South 00 5,327,442 00 4,330,717 -0 23.0 Warrior Met Coal Blue Creek No. 7* 00 4,864,828 00 3,067,565 -0 58.6 Arch Coal West Elk 00 4,821,281 00 4,156,405 -0 16.0 CONSOL Energy Harvey 00 4,805,208 00 2,971,179 -0 61.7 Canyon Consolidated Resources Skyline 00 4,374,500 00 4,538,021 00 -3.6 Murray American Energy Monongalia County 00 3,889,889 00 3,895,290 00 -0.1 Peabody Energy Twentymile 00 3,842,798 00 2,590,392 -0 48.3 Arch Coal Leer 00 3,381,442 00 3,572,262 00 -5.3 Alliance Resource Partners Mountain View 00 2,114,258 00 2,014,302 -00 5.0 Drummond Co. Inc. Shoal Creek 00 2,078,760 00 1,833,398 -0 13.4 Blue Mountain Energy Deserado 00 1,906,894 00 1,335,131 -0 42.8 Panther Creek Mining American Eagle 00 1,872,752 00 2,041,927 00 -8.3 Warrior Met Coal Blue Creek No. 4 00 1,849,387 00,0 343,771 - 438.0 Pacific Minerals Bridger 00 1,715,801 00 1,542,452 -0 11.2 UtahAmerican Energy Lila Canyon 00 1,629,311 00 1,586,720 -00 2.7 Arch Coal Mountain Laurel 00 1,509,675 00 1,478,926 -00 2.1 Mission Coal (ERP) Oak Grove 00 1,403,123 00 1,474,588 00 -4.8 Mission Coal (ERP) Pinnacle No. 50 00 1,237,167 00,0 921,453 -0 34.3 ERP Federal Mining Federal No. 2 00 1,103,582 00 1,507,373 0 -26.8 Ohio Valley Coal Powhatan No. 6 NA 00 2,815,831 - NA AmCoal New Future NA 00 1,406,428 - NA Total U.S. Longwall Production 167,811,013 153,195,700 -00 9.5 *Each of these mines operate two longwall faces.