Coal Age Magazine - For more than 100 years, Coal Age has been the magazine that readers can trust for guidance and insight on this important industry.

Issue link: https://coal.epubxp.com/i/961722

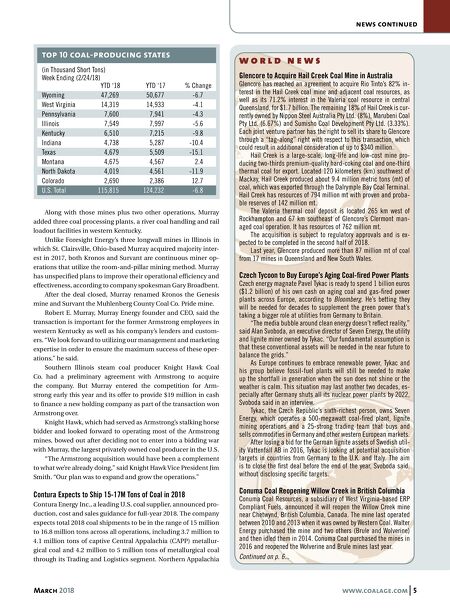

March 2018 www.coalage.com 5 news continued w o r l d n e w s Glencore to Acquire Hail Creek Coal Mine in Australia Glencore has reached an agreement to acquire Rio Tinto's 82% in- terest in the Hail Creek coal mine and adjacent coal resources, as well as its 71.2% interest in the Valeria coal resource in central Queensland, for $1.7 billion. The remaining 18% of Hail Creek is cur- rently owned by Nippon Steel Australia Pty Ltd. (8%), Marubeni Coal Pty Ltd. (6.67%) and Sumisho Coal Development Pty Ltd. (3.33%). Each joint venture partner has the right to sell its share to Glencore through a "tag-along" right with respect to this transaction, which could result in additional consideration of up to $340 million. Hail Creek is a large-scale, long-life and low-cost mine pro- ducing two-thirds premium-quality hard-coking coal and one-third thermal coal for export. Located 120 kilometers (km) southwest of Mackay, Hail Creek produced about 9.4 million metric tons (mt) of coal, which was exported through the Dalrymple Bay Coal Terminal. Hail Creek has resources of 794 million mt with proven and proba- ble reserves of 142 million mt. The Valeria thermal coal deposit is located 265 km west of Rockhampton and 67 km southeast of Glencore's Clermont man- aged coal operation. It has resources of 762 million mt. The acquisition is subject to regulatory approvals and is ex- pected to be completed in the second half of 2018. Last year, Glencore produced more than 87 million mt of coal from 17 mines in Queensland and New South Wales. Czech Tycoon to Buy Europe's Aging Coal-fired Power Plants Czech energy magnate Pavel Tykac is ready to spend 1 billion euros ($1.2 billion) of his own cash on aging coal and gas-fired power plants across Europe, according to Bloomberg. He's betting they will be needed for decades to supplement the green power that's taking a bigger role at utilities from Germany to Britain. "The media bubble around clean energy doesn't reflect reality," said Alan Svoboda, an executive director of Seven Energy, the utility and lignite miner owned by Tykac. "Our fundamental assumption is that these conventional assets will be needed in the near future to balance the grids." As Europe continues to embrace renewable power, Tykac and his group believe fossil-fuel plants will still be needed to make up the shortfall in generation when the sun does not shine or the weather is calm. This situation may last another two decades, es- pecially after Germany shuts all its nuclear power plants by 2022, Svoboda said in an interview. Tykac, the Czech Republic's sixth-richest person, owns Seven Energy, which operates a 500-megawatt coal-fired plant, lignite mining operations and a 25-strong trading team that buys and sells commodities in Germany and other western European markets. After losing a bid for the German lignite assets of Swedish util- ity Vattenfall AB in 2016, Tykac is looking at potential acquisition targets in countries from Germany to the U.K. and Italy. The aim is to close the first deal before the end of the year, Svoboda said, without disclosing specific targets. Conuma Coal Reopening Willow Creek in British Columbia Conuma Coal Resources, a subsidiary of West Virginia-based ERP Compliant Fuels, announced it will reopen the Willow Creek mine near Chetwynd, British Columbia, Canada. The mine last operated between 2010 and 2013 when it was owned by Western Coal. Walter Energy purchased the mine and two others (Brule and Wolverine) and then idled them in 2014. Conuma Coal purchased the mines in 2016 and reopened the Wolverine and Brule mines last year. Continued on p. 6... top 10 coal-producing states Along with those mines plus two other operations, Murray added three coal processing plants, a river coal handling and rail loadout facilities in western Kentucky. Unlike Foresight Energy's three longwall mines in Illinois in which St. Clairsville, Ohio-based Murray acquired majority inter- est in 2017, both Kronos and Survant are continuous miner op- erations that utilize the room-and-pillar mining method. Murray has unspecified plans to improve their operational efficiency and effectiveness, according to company spokesman Gary Broadbent. After the deal closed, Murray renamed Kronos the Genesis mine and Survant the Muhlenberg County Coal Co. Pride mine. Robert E. Murray, Murray Energy founder and CEO, said the transaction is important for the former Armstrong employees in western Kentucky as well as his company's lenders and custom- ers. "We look forward to utilizing our management and marketing expertise in order to ensure the maximum success of these oper- ations," he said. Southern Illinois steam coal producer Knight Hawk Coal Co. had a preliminary agreement with Armstrong to acquire the company. But Murray entered the competition for Arm- strong early this year and its offer to provide $19 million in cash to finance a new holding company as part of the transaction won Armstrong over. Knight Hawk, which had served as Armstrong's stalking horse bidder and looked forward to operating most of the Armstrong mines, bowed out after deciding not to enter into a bidding war with Murray, the largest privately owned coal producer in the U.S. "The Armstrong acquisition would have been a complement to what we're already doing," said Knight Hawk Vice President Jim Smith. "Our plan was to expand and grow the operations." Contura Expects to Ship 15-17M Tons of Coal in 2018 Contura Energy Inc., a leading U.S. coal supplier, announced pro- duction, cost and sales guidance for full-year 2018. The company expects total 2018 coal shipments to be in the range of 15 million to 16.8 million tons across all operations, including 3.7 million to 4.1 million tons of captive Central Appalachia (CAPP) metallur- gical coal and 4.2 million to 5 million tons of metallurgical coal through its Trading and Logistics segment. Northern Appalachia (in Thousand Short Tons) Week Ending (2/24/18) YTD '18 YTD '17 % Change Wyoming 47,269 50,677 -6.7 West Virginia 14,319 14,933 -4.1 Pennsylvania 7,600 7,941 -4.3 Illinois 7,549 7,997 -5.6 Kentucky 6,510 7,215 -9.8 Indiana 4,738 5,287 -10.4 Texas 4,679 5,509 -15.1 Montana 4,675 4,567 2.4 North Dakota 4,019 4,561 -11.9 Colorado 2,690 2,386 12.7 U.S. Total 115,815 124,232 -6.8