Coal Age Magazine - For more than 100 years, Coal Age has been the magazine that readers can trust for guidance and insight on this important industry.

Issue link: https://coal.epubxp.com/i/987749

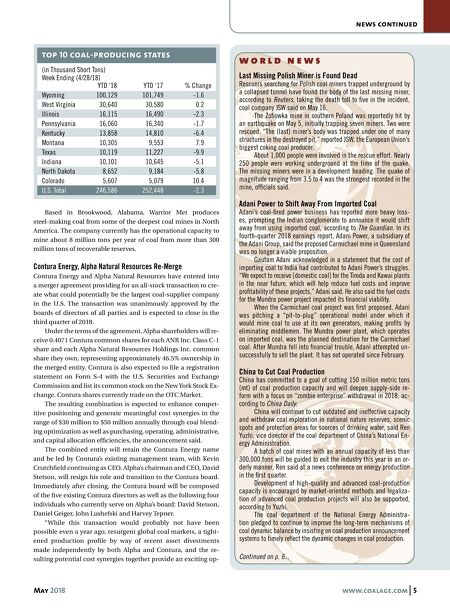

May 2018 www.coalage.com 5 news continued w o r l d n e w s Last Missing Polish Miner is Found Dead Rescuers searching for Polish coal miners trapped underground by a collapsed tunnel have found the body of the last missing miner, according to Reuters, taking the death toll to five in the incident, coal company JSW said on May 16. The Zofiowka mine in southern Poland was reportedly hit by an earthquake on May 5, initially trapping seven miners. Two were rescued. "The (last) miner's body was trapped under one of many structures in the destroyed pit," reported JSW, the European Union's biggest coking coal producer. About 1,000 people were involved in the rescue effort. Nearly 250 people were working underground at the time of the quake. The missing miners were in a development heading. The quake of magnitude ranging from 3.5 to 4 was the strongest recorded in the mine, officials said. Adani Power to Shift Away From Imported Coal Adani's coal-fired power business has reported more heavy loss- es, prompting the Indian conglomerate to announce it would shift away from using imported coal, according to The Guardian. In its fourth-quarter 2018 earnings report, Adani Power, a subsidiary of the Adani Group, said the proposed Carmichael mine in Queensland was no longer a viable proposition. Gautam Adani acknowledged in a statement that the cost of importing coal to India had contributed to Adani Power's struggles. "We expect to receive [domestic coal] for the Tiroda and Kawai plants in the near future, which will help reduce fuel costs and improve profitability of these projects," Adani said. He also said the fuel costs for the Mundra power project impacted its financial viability. When the Carmichael coal project was first proposed, Adani was pitching a "pit-to-plug" operational model under which it would mine coal to use at its own generators, making profits by eliminating middlemen. The Mundra power plant, which operates on imported coal, was the planned destination for the Carmichael coal. After Mundra fell into financial trouble, Adani attempted un- successfully to sell the plant. It has not operated since February. China to Cut Coal Production China has committed to a goal of cutting 150 million metric tons (mt) of coal production capacity and will deepen supply-side re- form with a focus on "zombie enterprise" withdrawal in 2018, ac- cording to China Daily. China will continue to cut outdated and ineffective capacity and withdraw coal exploration in national nature reserves, scenic spots and protection areas for sources of drinking water, said Ren Yuzhi, vice director of the coal department of China's National En- ergy Administration. A batch of coal mines with an annual capacity of less than 300,000 tons will be guided to exit the industry this year in an or- derly manner, Ren said at a news conference on energy production in the first quarter. Development of high-quality and advanced coal-production capacity is encouraged by market-oriented methods and legaliza- tion of advanced coal production projects will also be supported, according to Yuzhi. The coal department of the National Energy Administra- tion pledged to continue to improve the long-term mechanisms of coal dynamic balance by insisting on coal production announcement systems to timely reflect the dynamic changes in coal production. Continued on p. 6... top 10 coal-producing states Based in Brookwood, Alabama, Warrior Met produces steel-making coal from some of the deepest coal mines in North America. The company currently has the operational capacity to mine about 8 million tons per year of coal from more than 300 million tons of recoverable reserves. Contura Energy, Alpha Natural Resources Re-Merge Contura Energy and Alpha Natural Resources have entered into a merger agreement providing for an all-stock transaction to cre- ate what could potentially be the largest coal-supplier company in the U.S. The transaction was unanimously approved by the boards of directors of all parties and is expected to close in the third quarter of 2018. Under the terms of the agreement, Alpha shareholders will re- ceive 0.4071 Contura common shares for each ANR Inc. Class C-1 share and each Alpha Natural Resources Holdings Inc. common share they own, representing approximately 46.5% ownership in the merged entity. Contura is also expected to file a registration statement on Form S-4 with the U.S. Securities and Exchange Commission and list its common stock on the New York Stock Ex- change. Contura shares currently trade on the OTC Market. The resulting combination is expected to enhance compet- itive positioning and generate meaningful cost synergies in the range of $30 million to $50 million annually through coal blend- ing optimization as well as purchasing, operating, administrative, and capital allocation efficiencies, the announcement said. The combined entity will retain the Contura Energy name and be led by Contura's existing management team, with Kevin Crutchfield continuing as CEO. Alpha's chairman and CEO, David Stetson, will resign his role and transition to the Contura board. Immediately after closing, the Contura board will be composed of the five existing Contura directors as well as the following four individuals who currently serve on Alpha's board: David Stetson, Daniel Geiger, John Lushefski and Harvey Tepner. "While this transaction would probably not have been possible even a year ago, resurgent global coal markets, a tight- ened production profile by way of recent asset divestments made independently by both Alpha and Contura, and the re- sulting potential cost synergies together provide an exciting op- (in Thousand Short Tons) Week Ending (4/28/18) YTD '18 YTD '17 % Change Wyoming 100,129 101,749 -1.6 West Virginia 30,640 30,580 0.2 Illinois 16,115 16,490 -2.3 Pennsylvania 16,060 16,340 -1.7 Kentucky 13,858 14,810 -6.4 Montana 10,305 9,553 7.9 Texas 10,119 11,227 -9.9 Indiana 10,101 10,645 -5.1 North Dakota 8,652 9,184 -5.8 Colorado 5,607 5,079 10.4 U.S. Total 246,586 252,448 -2.3