Coal Age Magazine - For more than 100 years, Coal Age has been the magazine that readers can trust for guidance and insight on this important industry.

Issue link: https://coal.epubxp.com/i/1055558

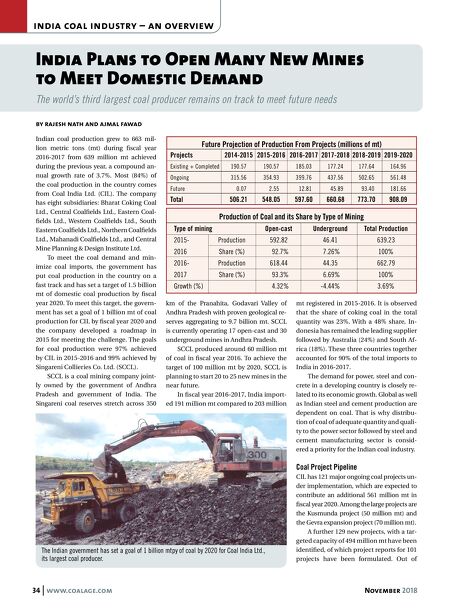

34 www.coalage.com November 2018 india coal industry – an overview India Plans to Open Many New Mines to Meet Domestic Demand The world's third largest coal producer remains on track to meet future needs by rajesh nath and ajmal fawad Indian coal production grew to 663 mil- lion metric tons (mt) during fiscal year 2016-2017 from 639 million mt achieved during the previous year, a compound an- nual growth rate of 3.7%. Most (84%) of the coal production in the country comes from Coal India Ltd. (CIL). The company has eight subsidiaries: Bharat Coking Coal Ltd., Central Coalfields Ltd., Eastern Coal- fields Ltd., Western Coalfields Ltd., South Eastern Coalfields Ltd., Northern Coalfields Ltd., Mahanadi Coalfields Ltd., and Central Mine Planning & Design Institute Ltd. To meet the coal demand and min- imize coal imports, the government has put coal production in the country on a fast track and has set a target of 1.5 billion mt of domestic coal production by fiscal year 2020. To meet this target, the govern- ment has set a goal of 1 billion mt of coal production for CIL by fiscal year 2020 and the company developed a roadmap in 2015 for meeting the challenge. The goals for coal production were 97% achieved by CIL in 2015-2016 and 99% achieved by Singareni Collieries Co. Ltd. (SCCL). SCCL is a coal mining company joint- ly owned by the government of Andhra Pradesh and government of India. The Singareni coal reserves stretch across 350 km of the Pranahita, Godavari Valley of Andhra Pradesh with proven geological re- serves aggregating to 9.7 billion mt. SCCL is currently operating 17 open-cast and 30 underground mines in Andhra Pradesh. SCCL produced around 60 million mt of coal in fiscal year 2016. To achieve the target of 100 million mt by 2020, SCCL is planning to start 20 to 25 new mines in the near future. In fiscal year 2016-2017, India import- ed 191 million mt compared to 203 million mt registered in 2015-2016. It is observed that the share of coking coal in the total quantity was 23%. With a 48% share, In- donesia has remained the leading supplier followed by Australia (24%) and South Af- rica (18%). These three countries together accounted for 90% of the total imports to India in 2016-2017. The demand for power, steel and con- crete in a developing country is closely re- lated to its economic growth. Global as well as Indian steel and cement production are dependent on coal. That is why distribu- tion of coal of adequate quantity and quali- ty to the power sector followed by steel and cement manufacturing sector is consid- ered a priority for the Indian coal industry. Coal Project Pipeline CIL has 121 major ongoing coal projects un- der implementation, which are expected to contribute an additional 561 million mt in fiscal year 2020. Among the large projects are the Kusmunda project (50 million mt) and the Gevra expansion project (70 million mt). A further 129 new projects, with a tar- geted capacity of 494 million mt have been identified, of which project reports for 101 projects have been formulated. Out of The Indian government has set a goal of 1 billion mtpy of coal by 2020 for Coal India Ltd., its largest coal producer. Future Projection of Production From Projects (millions of mt) Projects 2014-2015 2015-2016 2016-2017 2017-2018 2018-2019 2019-2020 Existing + Completed 190.57 190.57 185.03 177.24 177.64 164.96 Ongoing 315.56 354.93 399.76 437.56 502.65 561.48 Future 00 0.07 00 2.55 0 12.81 0 45.89 0 93.40 181.66 Total 506.21 548.05 597.60 660.68 773.70 908.09 Production of Coal and its Share by Type of Mining Type of mining Open-cast Underground Total Production 2015- Production 592.82 46.41 639.23 2016 Share (%) 0 92.7% - 7.26% 100% 2016- Production 618.44 44.35 662.79 2017 Share (%) 0 93.3% - 6.69% 100% Growth (%) 0 4.32% -4.44% 3.69%