Coal Age Magazine - For more than 100 years, Coal Age has been the magazine that readers can trust for guidance and insight on this important industry.

Issue link: https://coal.epubxp.com/i/1055558

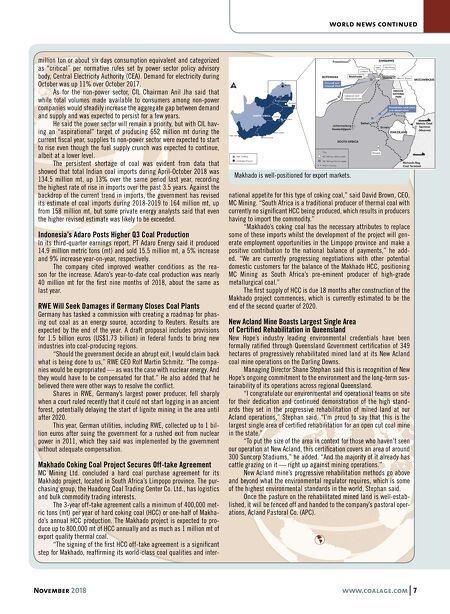

November 2018 www.coalage.com 7 world news continued million ton or about six days consumption equivalent and categorized as "critical" per normative rules set by power sector policy advisory body, Central Electricity Authority (CEA). Demand for electricity during October was up 11% over October 2017. As for the non-power sector, CIL Chairman Anil Jha said that while total volumes made available to consumers among non-power companies would steadily increase the aggregate gap between demand and supply and was expected to persist for a few years. He said the power sector will remain a priority, but with CIL hav- ing an "aspirational" target of producing 652 million mt during the current fi scal year, supplies to non-power sector were expected to start to rise even though the fuel supply crunch was expected to continue, albeit at a lower level. The persistent shortage of coal was evident from data that showed that total Indian coal imports during April-October 2018 was 134.5 million mt, up 13% over the same period last year, recording the highest rate of rise in imports over the past 3.5 years. Against the backdrop of the current trend in imports, the government has revised its estimate of coal imports during 2018-2019 to 164 million mt, up from 158 million mt, but some private energy analysts said that even the higher revised estimate was likely to be exceeded. Indonesia's Adaro Posts Higher Q3 Coal Production In its third-quarter earnings report, PT Adaro Energy said it produced 14.9 million metric tons (mt) and sold 15.5 million mt, a 5% increase and 9% increase year-on-year, respectively. The company cited improved weather conditions as the rea- son for the increase. Adaro's year-to-date coal production was nearly 40 million mt for the fi rst nine months of 2018, about the same as last year. RWE Will Seek Damages if Germany Closes Coal Plants Germany has tasked a commission with creating a roadmap for phas- ing out coal as an energy source, according to Reuters. Results are expected by the end of the year. A draft proposal includes provisions for 1.5 billion euros (US$1.73 billion) in federal funds to bring new industries into coal-producing regions. "Should the government decide an abrupt exit, I would claim back what is being done to us," RWE CEO Rolf Martin Schmitz. "The compa- nies would be expropriated — as was the case with nuclear energy. And they would have to be compensated for that." He also added that he believed there were other ways to resolve the conflict. Shares in RWE, Germany's largest power producer, fell sharply when a court ruled recently that it could not start logging in an ancient forest, potentially delaying the start of lignite mining in the area until after 2020. This year, German utilities, including RWE, collected up to 1 bil- lion euros after suing the government for a rushed exit from nuclear power in 2011, which they said was implemented by the government without adequate compensation. Makhado Coking Coal Project Secures Off-take Agreement MC Mining Ltd. concluded a hard coal purchase agreement for its Makhado project, located in South Africa's Limpopo province. The pur- chasing group, the Huadong Coal Trading Center Co. Ltd., has logistics and bulk commodity trading interests. The 3-year off-take agreement calls a minimum of 400,000 met- ric tons (mt) per year of hard coking coal (HCC) or one-half of Makha- do's annual HCC production. The Makhado project is expected to pro- duce up to 800,000 mt of HCC annually and as much as 1 million mt of export quality thermal coal. "The signing of the fi rst HCC off-take agreement is a signifi cant step for Makhado, reaffi rming its world-class coal qualities and inter- national appetite for this type of coking coal," said David Brown, CEO, MC Mining. "South Africa is a traditional producer of thermal coal with currently no signifi cant HCC being produced, which results in producers having to import the commodity." "Makhado's coking coal has the necessary attributes to replace some of these imports whilst the development of the project will gen- erate employment opportunities in the Limpopo province and make a positive contribution to the national balance of payments," he add- ed. "We are currently progressing negotiations with other potential domestic customers for the balance of the Makhado HCC, positioning MC Mining as South Africa's pre-eminent producer of high-grade metallurgical coal." The fi rst supply of HCC is due 18 months after construction of the Makhado project commences, which is currently estimated to be the end of the second quarter of 2020. New Acland Mine Boasts Largest Single Area of Certified Rehabilitation in Queensland New Hope's industry leading environmental credentials have been formally ratifi ed through Queensland Government certifi cation of 349 hectares of progressively rehabilitated mined land at its New Acland coal mine operations on the Darling Downs. Managing Director Shane Stephan said this is recognition of New Hope's ongoing commitment to the environment and the long-term sus- tainability of its operations across regional Queensland. "I congratulate our environmental and operational teams on site for their dedication and continued demonstration of the high stand- ards they set in the progressive rehabilitation of mined land at our Acland operations," Stephan said. "I'm proud to say that this is the largest single area of certifi ed rehabilitation for an open cut coal mine in the state." "To put the size of the area in context for those who haven't seen our operation at New Acland, this certifi cation covers an area of around 300 Suncorp Stadiums," he added. "And the majority of it already has cattle grazing on it — right up against mining operations." New Acland mine's progressive rehabilitation methods go above and beyond what the environmental regulator requires, which is some of the highest environmental standards in the world, Stephan said. Once the pasture on the rehabilitated mined land is well-estab- lished, it will be fenced off and handed to the company's pastoral oper- ations, Acland Pastoral Co. (APC). Makhado is well-positioned for export markets.